Nashville is emerging as one of the nation’s bright spots in the fight against rising auto loan delinquencies, according to a new report from WalletHub. The analysis, which examined delinquency trends in more than 500 U.S. cities, found that Nashville ranks among the cities where drivers are doing a better job staying current on their car payments.

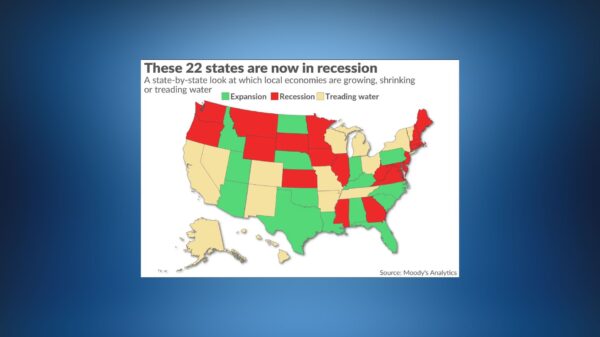

The WalletHub study comes at a time when many Americans are feeling the financial strain of high interest rates and persistent inflation. Across the country, auto loan delinquencies have been climbing, raising concerns about household debt and overall economic stability. But Nashville is bucking that trend, showing one of the sharpest declines in past-due car loans.

Experts say the improvement in Nashville may reflect both local economic strength and a resilient job market. Tennessee has consistently reported unemployment below the national average, and Nashville’s growing economy in sectors like healthcare, tech, and tourism has helped residents stay financially stable.

Auto loans are the second-largest type of consumer debt in the U.S., behind mortgages. With more than 100 million Americans carrying car loans, delinquency rates are a key signal of household financial health. WalletHub analysts said cities like Nashville provide a counterweight to troubling national data.

While the national picture remains mixed, the report suggests that Nashville drivers are finding ways to manage their auto debt, making the city a standout for financial resilience